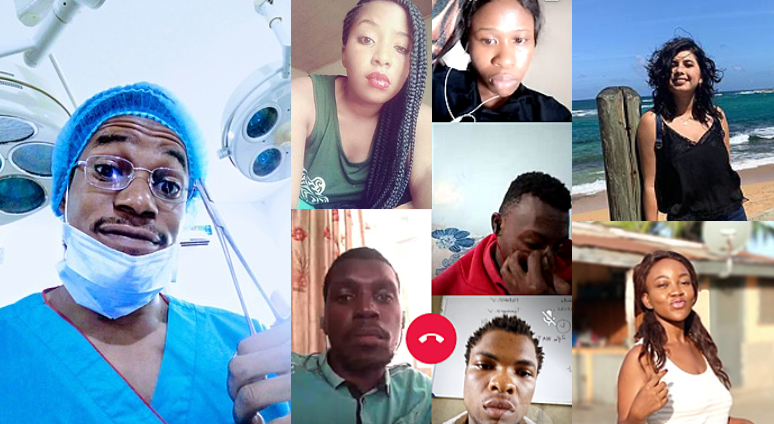

Participants in the Communication workshop post their selfies to the ExtendEd portal.

How does an educator convene a global classroom across a dozen countries, numerous cultures and differing perspectives? Sometimes, it’s better to instead let the students set the pace.

WDI’s Education Sector team recently tailored two fully online courses for The Ford Motor Company Fund as part of the Ford Community Impact Fellows Training program. Students accepted into the program work together to advance understanding and new thinking around topics such as innovation and entrepreneurship.

The courses were tailored to the students’ needs by key personnel at WDI’s Global Virtual Learning Center (GVLC), which was established to advance the field to create international linkages and promote economic growth in emerging markets. Students hailed from a dozen countries including Brazil, Ghana, Kenya, Mexico, Morocco and Sierra Leone.

“In this day and age, we all need to be continuous learners,” said Amy Gillett, vice president of the Education sector. “In a time when it’s difficult or impossible to bring people together face to face, this format is really effective and it also sets students up for making long-term connections with one another.”

The two fully online courses include one module on developing leadership qualities and a second on improving interpersonal communication skills. About 130 students participated in the leadership module, offered for seven weeks ending April 11, and 179 students are taking part in the five-week communications module, set to end July 12. The leadership course helped participants understand themselves as leaders on both personal and team levels, and drew on the Michigan Model of Leadership. The communications course emphasized cross-cultural communication, managing emotions and interpreting body language across different nationalities and traditions.

WDI produced the content for the courses, which were hosted on the ExtendEd portal – the Institute’s proprietary learning management system. Students viewed a series of instructional videos on ExtendEd, followed by quizzes to check for comprehension. Students were assigned to teams across countries to work on a project together and practice their new leadership skills.

While the students were from many different countries, pursuing a wide variety of degrees and occupations – from business to medicine – a well-designed online learning environment was a perfect vehicle for bringing them together.

“It’s an efficient way to reach people with targeted training, and it’s the way people prefer to learn,” said Gillett. “They want to learn when they have time to learn, even if it’s in 15-minute increments. Students log in at their own pace, learn at their own pace, and take the modules on any device.”

The course is a perfect example of a small private online community – or SPOC – which is designed to nurture an intimate learning environment where students can interact and get to know one another other.

At the conclusion of the modules, WDI hosts a live webinar to summarize the learning. This is followed by sending participants a series of reminders on what they learned in the course. Such reminders — “Memory Pings” — also prompt them to apply what they learn in the course back on the job.

“It’s vitally important to provide opportunities for tomorrow’s leaders to share new ideas and brainstorm sustainable solutions to make people’s lives better,” said Farah Harb, Global Education Programs Analyst, Ford Motor Company Fund. “Learning and leadership are essential as we navigate and adapt to our constantly changing world.”

Many students found the WDI courses very valuable.

“Giving back to society and creating positive (impact) has always been my passion. In the world, there are so many challenges facing us,” … to fix these problems, the world needs great leaders with great leadership skills and this course has shown me surely that great leaders can be created or trained,“ wrote one student of the Leadership workshop.

Another student noted: “This workshop has been an eye opener and I am certain I am ready to work in every environment.”

As a final assignment, the students submitted videos exploring cross-cultural learning and how to apply that knowledge to real-world scenarios. The finalists for the contest and their video stories, can be found below:

WDI created an 8-week online course: Starting a Business: Your Entrepreneurial Journey. The pilot program ran in April-May 2023. The course consisted of live training sessions, guest talks, short videos, online quizzes, and a capstone project in which participants worked in teams to conceptualize and pitch a new business via a video. The video was then judged by the program mentors and winning teams received a special certificate. The pilot program had 88 participants from nine countries.

Photo by Erica Leong on Unsplash

Government health ministries in low- and middle-income countries (LMICs) have historically struggled to adequately fund healthcare services for their citizens. But as these countries transition away from donor funding over the next two decades, many will need to find new domestic revenue streams to finance these services. A new WDI white paper explores the impact of raising additional government revenue through increased tax rates on “bads,” such as tobacco, alcohol and sugary drinks.

The paper, “Revenue Estimates from Taxing ‘Bads’ in 16 Low- and Middle-Income Countries,” estimates the additional revenue generated in 2016 had higher excise tax rates been imposed on tobacco, alcohol and sugary drinks and then compares this revenue to select national economic indicators. The analysis included 16 low- and middle-income countries: Côte d’Ivoire, Democratic Republic of the Congo, Ethiopia, Haiti, India, Lao People’s Democratic Republic, Moldova, Myanmar, Niger, Papua New Guinea, Rwanda, Senegal, Sierra Leone, Tajikistan, Tanzania and Togo.

Ben Davis

“The key finding is that increased excise tax rates that result in only a modest increase in retail price can still generate an important amount of additional revenue relative to current health expenditure,” said Ben Davis, a research manager with WDI’s Healthcare sector. Davis wrote the paper with Pascale Leroueil, vice president of WDI’s Healthcare sector, and William Savedoff, senior fellow at the Center for Global Development.

The simulations showed that in 14 of the 16 countries, a tax increasing retail price by 17% could generate additional revenue that is more than 50% of the amount these governments currently spend from their own budgets on healthcare. For 7 of the 16 countries, additional revenue is more than 100% of that amount.

Davis emphasized that the study has limitations. For example, estimates do not account for income and cross-substitution effects (or when consumers switch to cheaper alternatives when a product’s price rises), and they are not adjusted based on historical experience in raising tax revenues.

While the results of the current study are broadly aligned with those recently produced by the Bloomberg Philanthropies’ Task Force on Fiscal Policy for Health, there is a slight difference in methodology. The method used by Davis and his fellow authors allowed them to incorporate several different data sources and calculation methods in the final revenue estimates. Input data were obtained from public databases, journal articles, and LMIC government websites and then used in either a “bottom up” or a “top down” calculation. The “Bottom up” calculation begins with data showing how often individuals consume tobacco, alcohol and sugary drinks while the “top down” calculation begins with the amount of money actually collected by LMIC governments that taxed these products.

Davis said these estimates could act as a starting point for a discussion between global donor organizations and country governments. “A government stakeholder might say, ‘These results are interesting. An increased excise tax on these products might be worth considering. Let’s do a deeper analysis to make sure these numbers reflect reality when we take into account all of the factors that couldn’t be captured in the initial study.’”

“This paper is a small part of a larger conversation about domestic revenue mobilization and healthcare financing in low- and middle-income countries,” Davis said. “It is a building block.”

This white paper is a modest contribution to the existing body of knowledge on potential revenue benefits from taxation of “bads” in low- and middle-income countries (LMICs). We seek to provide orders-of-magnitude responses to the questions, “For 16 LMICs, what amount of additional government revenue could have been generated in 2016 if higher excise tax rates had been imposed on tobacco, alcohol, and sugar-sweetened beverages?”, and “How does this additional government revenue compare to select national economic indicators?”.