Perspective: Making the e-mobility transition a global one

Tuesday, March 7, 2023

Energy + Mobility

Every country should have a role in the coming electric future

By Diana Páez and Dana Gorodetsky with research by Dylan Kapur

The United States, China and the European Union have earned many of the eye-grabbing headlines on electric vehicle (EV) technologies and adoption in the last few years. However, low- and middle-income countries (LMICs) are not taking a back seat. Many players in these markets are moving rapidly in business innovation, government strategies and investment to support the transition, albeit on a smaller scale than the higher-income economies of the world. Understanding these dynamics has been key to our research on the WDI Energy team, tracking trends and best practices around the world and in key LMIC markets, and synthesizing and applying this knowledge in our own work with energy and mobility companies and stakeholders.

Our recently published report, “Mapping the e-Mobility Transition: Opportunities and Enablers*,” examined the implications of this transition. Importantly, we’re emphasizing the changes and opportunities from a production point of view and how these are playing out in different markets. While we primarily focused on the light duty vehicle segment, we also touched on a few others that are quickly electrifying, or have the potential to do so relatively easily. The report addressed two main areas: high potential business opportunities along the EV value chain and the enabling ecosystem, including key players capable of facilitating the shift to producing EVs in a given market.

Business opportunities

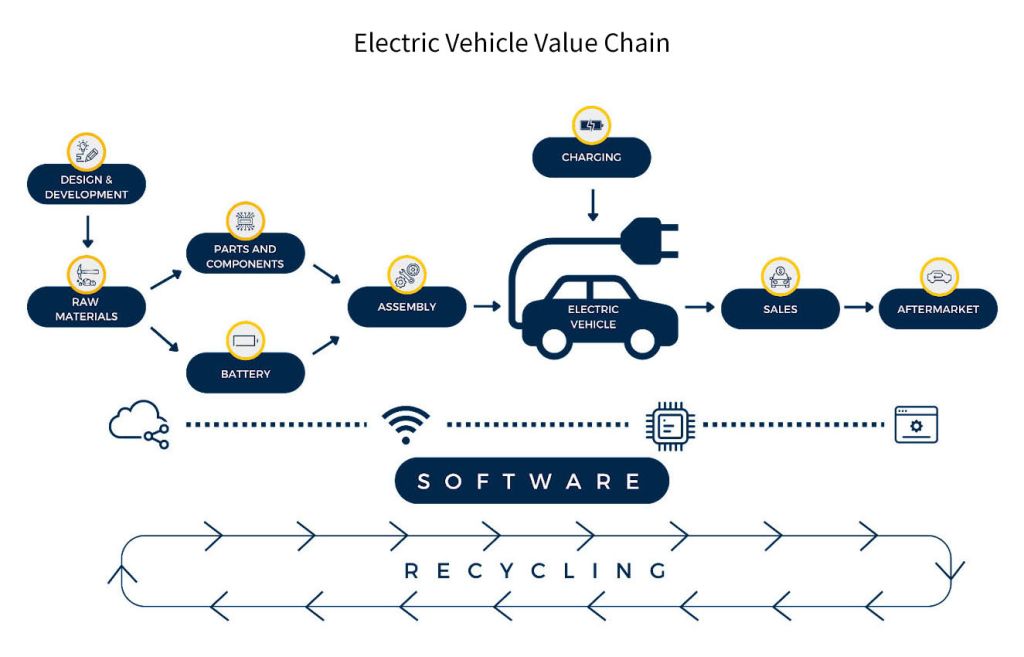

It is no secret that EVs represent a major shakeup for the automotive industry. And while this shakeup brings several challenges, we focused our research on identifying some of the many business opportunities that this shift creates. Taking a prospective approach, we looked at trends we expect will be relevant in the next five to 10 years and identified short- and medium-term opportunities for businesses, which we organized along each part of the value chain. (See Figure 1 below). In the report, we discuss these opportunities in more depth, including key drivers as well as skills and expertise needed to engage in these opportunities.

FIGURE 1

Source: WDI based on industry research.

Ecosystem

Adapting to a technology shift of this magnitude necessitates an enabling environment and ecosystem of support that can make it possible for players to capitalize upon the opportunities that e-mobility brings. Indeed, adopting an ecosystem view can help companies and stakeholders identify complementarities and interdependencies with other players and build catalytic linkages to create more value. The ecosystems best positioned to seed the innovation needed to power this transition will need the right resources, players and enablers to shake up the status quo. In our report, we looked at players and enablers that are relevant to the e-mobility transition:

Players

Various players can enable the transition, including government, industry, entrepreneurs, investors, academia and interest groups. Depending on the context, there may be players that operate across areas and work to add value by connecting the dots. Our report identifies important features for each player in the context of navigating this shift, as well as the dynamic linkages among them in a given context. As an example, industry and academia can collaborate on talent development and engagement; industry also sponsors research, shares data, and commercializes research; academia provides expertise and serves as a platform for the exchange of ideas.

Enablers

A country or region’s policy framework, infrastructure and workforce are the three key enablers supporting the EV shift. To better understand how these enablers can bring it about, we examined six markets: the U.S. states of Michigan and California plus India, China, South Africa and Brazil. These markets were selected due to their focus and recent efforts around e-mobility, as well their existing automotive manufacturing capacity.

Looking at the experiences in these markets, we identified examples of promising strategies to strengthen the three key enablers. These include:

- Policy: establishing a dedicated entity to roll out an e-mobility policy can help coordinate inputs of the various stakeholders that need to be involved.

- Infrastructure: developing a mobility hub to concentrate innovation initiatives and related services can serve as an anchor investment and further grow the ecosystem in a given market or region.

- Workforce: developing robust and diverse e-mobility related offerings including credentials, certifications and hands-on workshops can help prepare the talent pipeline and reskill or upskill the current automotive workforce.

Now is the time for action

Do decision-makers across sectors really need to do something about e-mobility right now? you may ask. “Yes,” we would answer. “Why?” Take a look at three key trends that capture the size and speed of the transition we are witnessing:

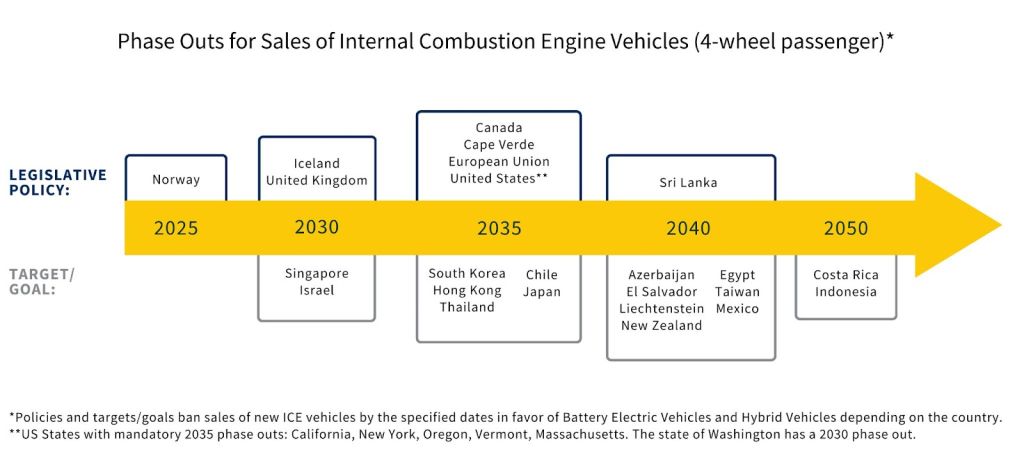

ICE phase-outs

Governments around the globe are taking action to decarbonize the transportation sector using different tools, including establishing bans on the sale of internal combustion engine (ICE) vehicles or announcing targets and plans to do so in the near term. Looking at some of the latest announcements (Figure 2 below) we see a clear divide between developed nations with resources and domestic policies in place to ensure that their goals can be achieved, and developing nations who have transition plans and targets but no official commitments yet. We expect more policy action in this front going forward.

FIGURE 2

Source: Compiled by WDI based on sources available here.

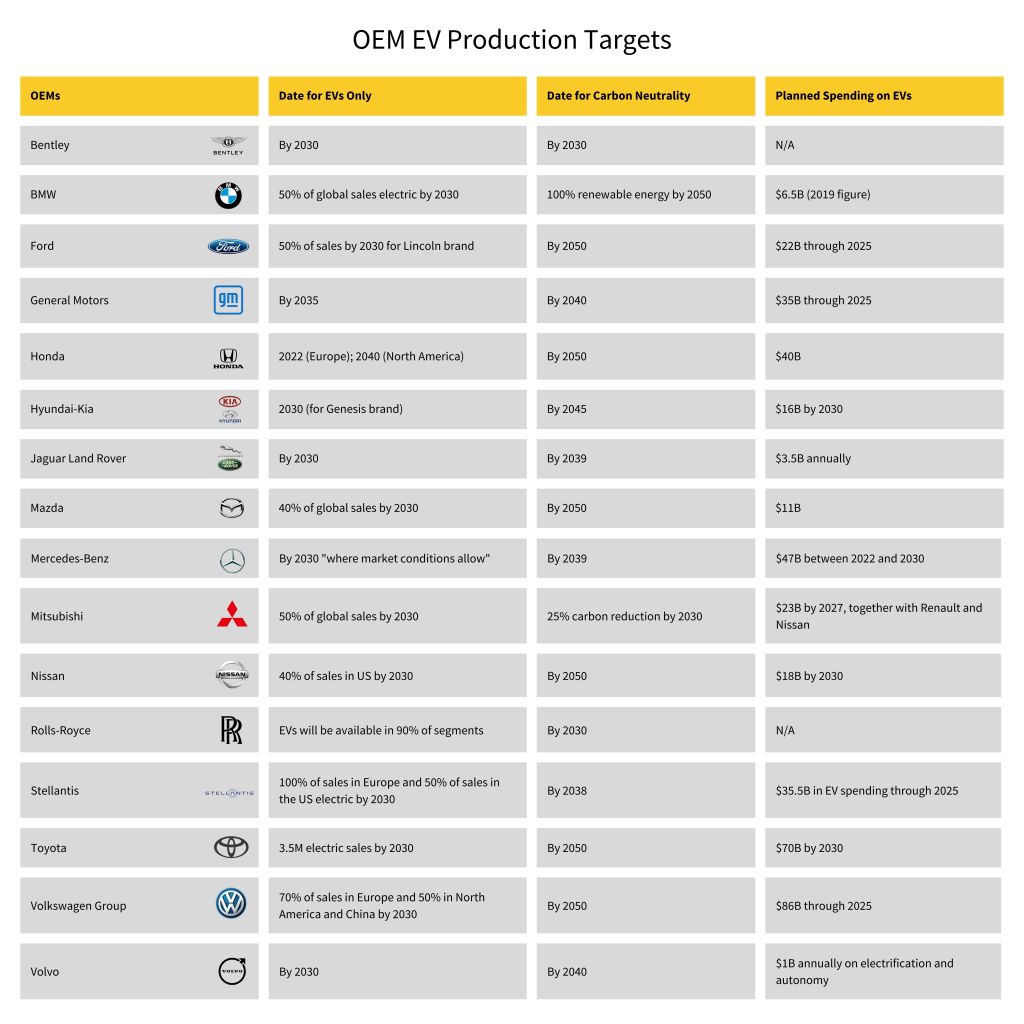

OEM electrification goals and investments

Most of the world’s major OEMs have announced targets for electrifying their product lines, decarbonizing their businesses, and making other investments in these areas. Developed by WDI from multiple sources, the chart below (Figure 3) lists major OEMs and their related announcements as of February 2023. Nearly every OEM plans to significantly shift their product line to EVs by 2030, whether by only producing battery EVs (i.e., not including hybrids), or having EVs represent a significant share of global sales. This shift involves billions of dollars in investments. OEMs are also taking a more holistic view of decarbonization by setting targets to make their businesses carbon neutral – this will be a significant endeavor involving all of their operations as well as their products, and as such, some of these targets are longer term (2040-2050). As with other aspects of the transition, OEM ambitions are changing rapidly, with important implications for the entire value chain.

FIGURE 3

Source: Compiled by WDI with information from Forbes, Consumer Reports, and various automaker websites.

EV adoption trends

Many stakeholders are tracking EV adoption rates in different markets, and projections are made and updated often as new policies and other developments influence this ever-dynamic sector. After examining EV adoption trends and projections across several major markets , ranging from high- to medium- and low-income, we want to highlight a few patterns. (Sources for this analysis include BloombergNEF, Bain & Company, The Wall Street Journal, International Energy Administration, McKinsey & Co. and Fitch Solutions)

First, when looking at actual EV adoption rates in recent years, as measured by percentage of new passenger vehicles sold that are EVs, it is no surprise that China and Europe are well ahead of the rest of the world (with estimates of 15% and 20% respectively, compared to a global rate of 8.5%). The EV share in these markets is expected to continue growing at a fast clip through 2030, reaching approximately 50% by some estimates. In the U.S., EVs accounted for 5.8% of all new cars sold, an increase of 65% relative to 2021. The passage of the Inflation Reduction Act, with substantial funding and provisions to boost EV production and adoption, triggered updated projections to be on par with China and Europe in terms of EV adoption by 2030.

Unsurprisingly, EV adoption in LMIC markets tended to be 2% or lower in 2021. While the percentage growth in these markets has been quite high in recent years and is projected to stay high, the overall share is not projected to grow to more than 5% by 2030 in countries like India, South Africa and Mexico, among others. This doesn’t, however, tell the full story when it comes to electrification in LMIC markets, since other segments are electrifying much more quickly; two-wheel and three-wheel vehicles as well as public buses are expected to lead adoption in many of these markets in the near and medium term.

In some cases, governments are announcing ambitious targets that significantly exceed current market projections; without substantial measures to boost demand such as incentives or other policies, these goals are unlikely to be achieved. Projections beyond 2030 are difficult to make given how quickly this industry is changing, but various sources anticipate that adoption will start to level off by then in developed markets, while developing markets will continue growing at a modest pace.

Looking down the road

Around the globe, we are witnessing action from government, industry, academia and other players whose roles are crucial in enabling the transition to e-mobility. Many questions regarding the full impact of this shift writ large remain, including:

- How to ensure humane, clean and sustainable supply chains?

- How to accelerate decarbonization efforts along the EV lifecycle and through our energy systems to fully reach the potential of this technology?

- How to ensure a just transition for the current automotive workforce and communities?

- How best to support developing countries moving through this transition?

- How to best help companies innovate to play a role in the EV value chain and drive economic growth?

Even with these questions, the push towards e-mobility is clear and therefore so is the need for action.

*This report was developed as part of WDI’s project with the State of Chihuahua in Mexico to develop a roadmap for the transition to e-mobility. You can learn more about this project here.

Dana Gorodetsky

Program Manager, Energy