Emerging markets are home to 86% of the world’s population and account for 60% of global domestic product. Yet these countries currently represent only a small fraction of global market capitalization—around 10–12%, according to Morgan Stanley International.

Now entering its sixth year, the International Investment Fund (IIF) was created specifically to address this investment gap. Founded with support from the William Davidson Institute, the fund—managed as a graduate student course, offered at the Stephen M. Ross School of Business—is designed to leverage private capital as a resource for addressing pressing social and environmental challenges in emerging markets. Enrolled graduate students at the Ross School of Business and other University of Michigan schools take on many aspects of the due diligence process behind financing small and medium-sized enterprises (SMEs) worldwide, working not only with entrepreneurs but also with incubators, accelerators, and investors.

IIF has engaged hundreds of students pursuing their MBA at Michigan Ross and other graduate schools at the University of Michigan e.g. Ford School of Public Policy and the Rackham Graduate School of Engineering, to name a few. The course is taught by Gautam Kaul, Professor of Finance at Ross, and immerses students in the world of financing small and medium-sized enterprises in India and across multiple African countries. Leveraging seed funding from WDI, IIF has invested in three startups.

“The International Investment Fund (IIF) exemplifies a new model of education at a top research university—it is multidisciplinary, research- and action-based, in a global context,” said Kaul. “Instead of being exposed to different disciplines and skills in a classroom, our graduates learn all aspects of business—from strategy to marketing to financial valuation—by conducting due diligence on new companies, deciding whether to invest, and supporting our portfolio companies.”

The fund has focused on evaluating enterprises in agriculture, energy and climate action, healthcare, financial inclusion, transportation, and educational technologies. Students also focus on investment strategy and must pay close attention to the cultural contexts in which those investments are made. Their work includes conducting due diligence on potential investments and executing capacity-building projects for portfolio companies.

The course is available to masters and PhD students, who may serve in management roles during their second year in the fund. During the 2024–25 academic year, 40 students enrolled in the class.

IIF partnered with a leading accelerator in Kenya, Baobab Network, which has invested in more than 65 portfolio companies across 16 African markets. Last year, IIF sourced seven startups from Baobab, with the fund’s student members performing comprehensive commercial and financial due diligence on these companies for investment purposes. These startups operate in various sectors, including healthcare and climate action, across four African markets.

Second-year Michigan Ross MBA student, Takudzwa Muravu, who is serving as IIF’s Managing Director for the 2025–26 academic year, said partnering with Baobab has taken the fund to a new level.

“Baobab has the boots on the ground, first-hand experience, and deep knowledge of the venture capital ecosystem across Africa,” Takudzwa said. “We bring financial and commercial insights backed by a leading world-class institution—it’s a very synergistic partnership.”

A native of Zimbabwe, Takudzwa earned an undergraduate degree in management studies and previously worked for leading global professional services firms, BDO, KPMG and EY, conducting valuations and financial due diligence for private equity and corporate clients.

“From a personal perspective, I’ve been able to develop much more of an investor mindset,” Muravu said. “Thinking from the lens of the investor is a more holistic approach; I didn’t have that multifaceted mindset before joining IIF.”

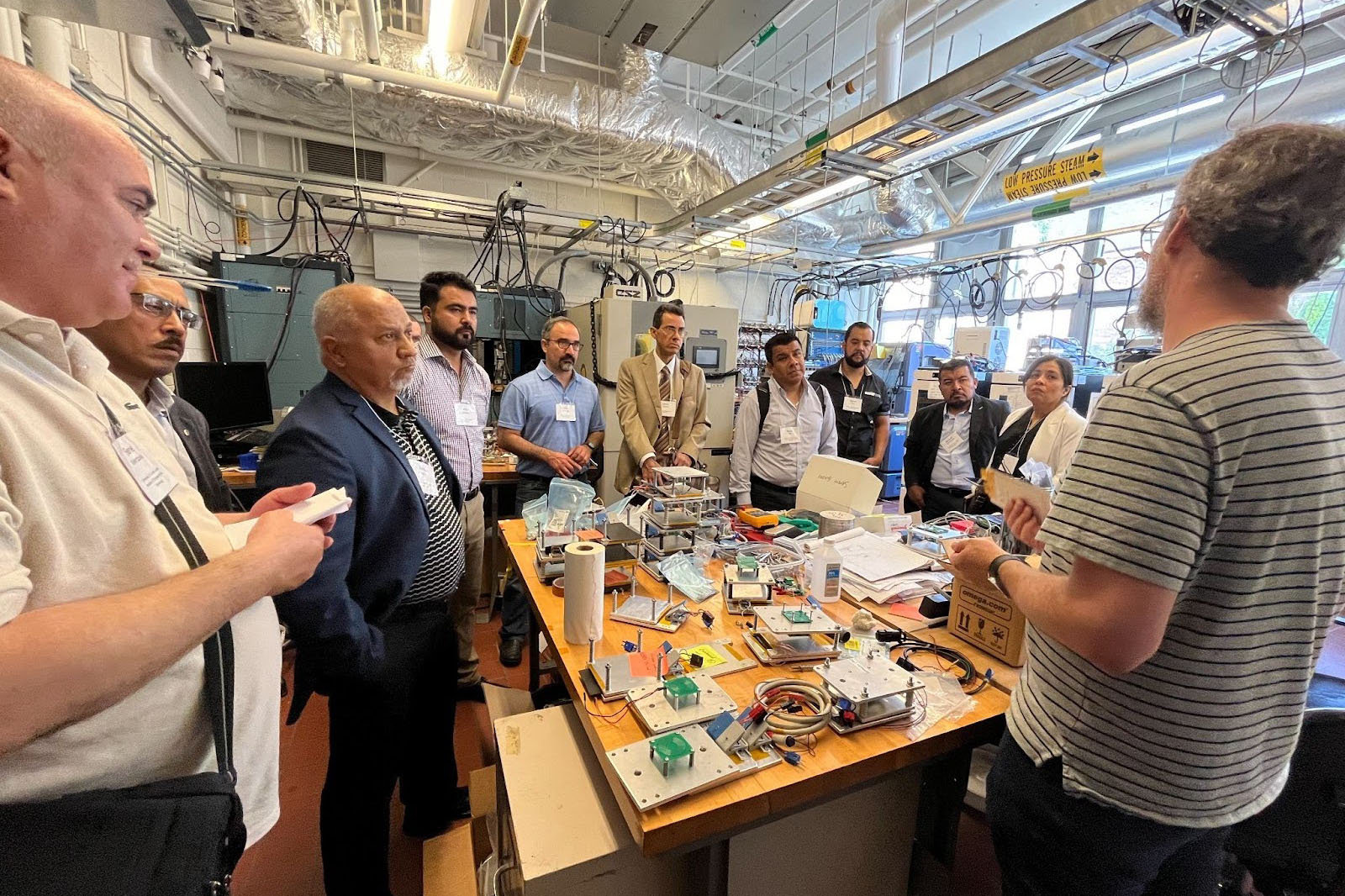

The IIF team conducted due diligence in seven African countries this year. In Nairobi and India, the IIF team strengthened relationships with both new and existing partners while deepening their understanding of entrepreneurial and venture capital ecosystems—knowledge they aim to apply to future due diligence and investment decisions.

In 2024, IIF invested in a seed financing round led by Baobab Network into Kawu, a fintech firm that developed a smart card application enabling students in remote Ugandan boarding schools to receive and withdraw money from parent-approved accounts. In 2021, IIF invested in DohYangu, a Kenya-based firm that operates a cashback app rewarding shoppers for purchases made via mobile money applications. And in July 2025, IIF completed a pre-seed investment in Swyft, a Cameroonian logistics tech startup focused on business-to-business and business-to-consumer delivery services in both major metropolitan areas and remote last-mile locations.

The International Transactions Clinic (ITC) at the University of Michigan Law School is a key partner of the IIF. Law students from the clinic conduct legal due diligence on IIF’s deals. Entrepreneurs partnering with IIF also have praised the fund’s multidisciplinary approach.

“This partnership represents a pivotal milestone in our journey to modernize logistics across Cameroon and beyond. We’re solving real problems in first-to-last-mile delivery, and it’s incredibly validating to have a partner like IIF who not only believes in our mission but is committed to helping us scale,” said Swyft Founder and CEO Franck Batchadji. “We’re deeply grateful to the fund for recognizing the urgency and importance of the logistics challenges we’re addressing.

“We also want to thank IIF for identifying the critical problems we are solving in the first-to-last-mile space, and we extend our appreciation to all the students who challenged our assumptions and provided invaluable, constructive insight throughout this process. We are incredibly excited for the continued mentorship and support we’ll receive from the entire IIF community.”

IIF’s focus on entrepreneurship support organizations and the systems behind entrepreneurs dovetails with WDI’s strategy as an enterprise accelerator, said WDI President and CEO Wendy Taylor.

“We’re incredibly proud of what IIF students have accomplished in just a few years,” Taylor said. “So much of WDI’s work is about creating connections and ultimately elevating impact. This fund immerses students in all aspects of the investor–investee relationship, while contributing to an ecosystem that fuels innovation not only in emerging markets but here in the U.S.”

Building off the learnings from IIF, WDI is piloting the Frontier Finance Lab, a new program to equip U-M MBA and law students with hands-on experience in impact finance while supporting enterprises and technical assistance (TA) facilities in emerging markets. Working in partnership with ITC and Ross, the Lab aims to connect top student talent to blended finance vehicles and donor-backed catalytic funds, preparing early to growth-stage companies to attract private and impact capital and scale their impact.

All images courtesy of the IIF team from their 2025 trip to Kenya.