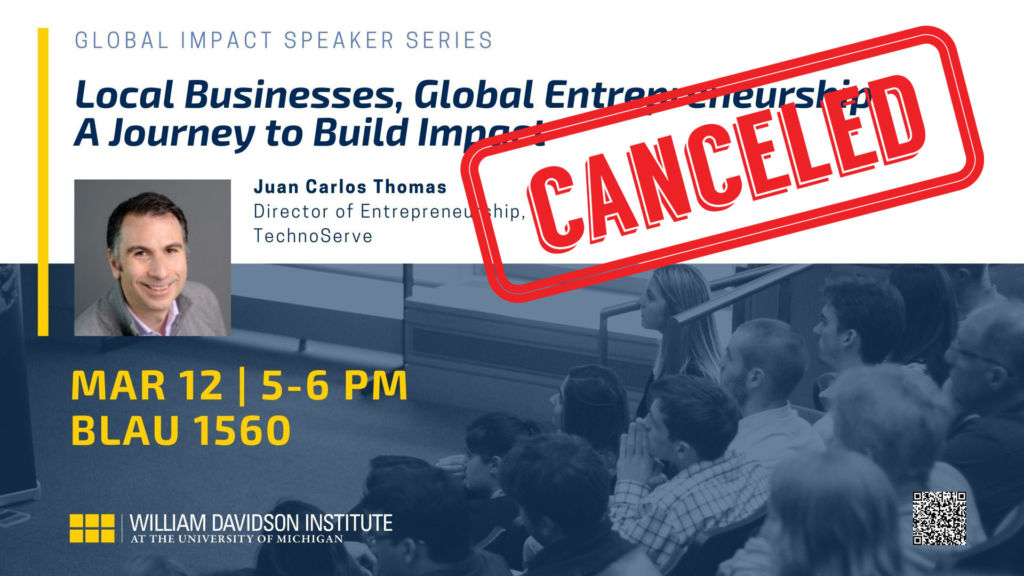

Juan Carlos Thomas, Director of Entrepreneurship at TechnoServe, a nonprofit organization focused on harnessing the power of the private sector to help people lift themselves out of poverty, will be the next WDI Global Impact Speaker. TechnoServe was recently rated the No. 1 nonprofit for reducing poverty by ImpactMatters.

Juan Carlos Thomas

Thomas’s talk, “Local Businesses, Global Entrepreneurship: A Journey to Build Impact,” will explore effective ways to support entrepreneurs and small and growing businesses around the world. It is scheduled for 5-6 p.m., March 12 in Room B1560 (Blau Building) at the University of Michigan’s Ross School of Business. The discussion is free and open to the public.

Thomas leads the development and deployment of best practices in the support of entrepreneurs and small and growing businesses in the organization’s projects. Before assuming his current role, he served as TechnoServe’s Chile Country Director. Among his accomplishments in that role, he led the first inclusive business development program in Chile; the first small business accelerator program in Patagonia; several economic development programs in communities surrounding energy and mining projects; and the design of business development methodologies now being used in Latin America and Africa.

Before opening the TechnoServe office in Chile in 2008, Thomas served as a TechnoServe Fellow. He previously worked in the Corporate Finance and Capital Markets division at Bank Boston Chile. He has lectured on finance, entrepreneurship and social entrepreneurship at various universities. Thomas holds an MBA from INSEAD and a bachelor’s degree from Universidad Adolfo Ibáñez.

By Paul Clyde and Colm Fay

Pay as you go (PAYG) off-grid energy access business models are often vertically integrated, in that they include elements of manufacturing, distribution, consumer financing, payment collection and after-sales service. A topic of some debate within the PAYG sector is whether unbundling these business models, perhaps more accurately described as “disintegration,” is good or bad for the sector. Disintegration, or the outsourcing of aspects of the business model to service providers, provides more opportunities for specialization, which can result in more cost-effective business models. Indeed, some wonder whether companies in nascent energy markets might be better off avoiding vertical integration altogether and moving straight to disintegrated models.

We argue that vertical integration is neither inherently good, nor bad. It is a strategic decision for a business that depends on the presence of potential service providers, and the perceived risk of investments specific to that particular context. In the case of nascent markets like household energy access in low- and middle-income countries (LMICs), vertical integration may be a necessary step to overcome the reluctance of service providers to make these investments early in the life cycle of the market.

This debate has played out in many other industries. Perhaps the most examined example is General Motors’ purchase of Fisher Body one hundred years ago.[1] According to one version of the story, General Motors wanted to begin selling metal closed-body cars – a completely different body style than used by any other automaker at the time, and a component that required very expensive stamping equipment to make. Fisher made the investment in the equipment, but only after assurances that it would be able to recover its investment and GM would not take advantage of it. These assurances came in the form of a 10-year exclusive contract for Fisher Body to supply car bodies to GM. However, GM’s sales volumes were much higher than expected. At the high unit price that Fisher had negotiated to protect its investment, Fisher was making a huge margin, much larger than either GM or Fisher anticipated. The difficulty in addressing this by revising the contract to account for all possible contingencies ultimately led GM to vertically integrate by purchasing Fisher Body in 1926.[2]

Since the initial article by Klein et al., many more have been written on the GM story, some disputing the facts and conclusions.[3] Nonetheless, the concept illustrated by the GM-Fisher Body story took hold. Specifically, a driving factor in the decision about whether or not to vertically integrate is the degree to which investments in assets to provide a critical service or input are tied to a specific context, a concept known in economics as asset specificity.[4] Vertical integration into specific assets has been shown in a wide variety of other industries including aerospace, shoes, textiles and pharmaceuticals.[5]

It is also similar to any number of present-day sellers and distributors of solar home systems (SHS) who may decide to incorporate consumer financing to deliver a PAYG value proposition. Generating revenue from SHS requires a component (e.g. hardware or software) that integrates solar panels with a consumer payment platform. That component would be specific to the SHS provider. The SHS provider could offer to pay a third party to develop the technology and the accompanying financing system, but any potential third-party provider would be justifiably concerned by the notion of making a big investment in the technology, only to see the SHS provider refuse to pay the initially agreed-upon price. If that happened, the technology/financing provider, having no viable alternatives, would be compelled to take the lower payment because it’s better than nothing. In the economics literature, the technology/financing provider is described as being “held up.” Realizing this, a technology/financing provider would require some assurance that they would be able to recoup their investment before they make it. This assurance could be very costly to provide, and the SHS provider may determine that developing the technology and the financing themselves is a better option.

Vertical integration can happen in either direction from a firm’s starting point in the value chain. Backward integration implies engaging in upstream activities that would previously have been executed by the supplier of an input or service. Forward integration implies engaging in downstream activities that would previously have used a product or service provided by the firm. When it comes to PAYG, one might look at provision of financing as an inseparable input into a value proposition that includes both product (solar panels, invertors, appliances) and service (financing, remote management) components – and therefore an example of backwards integration. Thomas Edison did something similar when he built his own electric utility to support the lightbulb he invented. Without the service provided by the first grid in downtown Manhattan, Edison’s lightbulb would have had limited appeal and market potential. Given that the success of the electric utility was tightly coupled to the success of the first lightbulb, it’s also not surprising that Edison himself was the only one willing to make the investment in such a specific asset.

Forward integration is prevalent in the household energy access sector as well, with many SHS providers also acting as distributors of consumer appliances. Investing in an appliance distribution network that can reach new energy consumers tied to an unproven SHS provider may be too specific an investment and therefore too risky for traditional appliance distributors. However, appliances ultimately drive demand for energy. With greater insight into the end customers and needing fewer assurances, forward integration could become feasible for that SHS provider – and perhaps even necessary. Indeed, it is entirely possible that as it develops more knowledge about the distribution of appliances, and as the industry moves towards disintegration, this same company may emerge with its comparative advantage being appliance distribution rather than, or in addition to, energy provision.

This debate has played out in many other industries. Perhaps the most examined example is General Motors’ purchase of Fisher Body one hundred years ago.[3] According to one version of the story, General Motors wanted to begin selling metal closed-body cars – a completely different body style than used by any other automaker at the time, and a component that required very expensive stamping equipment to make. Fisher made the investment in the equipment, but only after assurances that it would be able to recover its investment and GM would not take advantage of it. These assurances came in the form of a 10-year exclusive contract for Fisher Body to supply car bodies to GM. However, GM’s sales volumes were much higher than expected. At the high unit price that Fisher had negotiated to protect its investment, Fisher was making a huge margin, much larger than either GM or Fisher anticipated. The difficulty in addressing this by revising the contract to account for all possible contingencies ultimately led GM to vertically integrate by purchasing Fisher Body in 1926.[4]

Since the initial article by Klein et al., many more have been written on the GM story, some disputing the facts and conclusions.[5] Nonetheless, the concept illustrated by the GM-Fisher Body story took hold. Specifically, a driving factor in the decision about whether or not to vertically integrate is the degree to which investments in assets to provide a critical service or input are tied to a specific context, a concept.

“Rather than being an inherently good or bad thing, vertical integration in off-grid energy (or any industry for that matter) is often a necessary feature of early-stage market development…”

As markets mature, the degree to which asset specificity requires integration can be expected to wane, allowing for vertically integrated models to be disintegrated, or for new entrants to avoid vertical integration altogether. There are a few reasons for this.

First, mature markets are generally characterized by a larger number of buyers and sellers. If there is more than one trading partner, the asset is no longer specific to a particular trading partner.

Firms subject to the risks of asset specificity have developed some clever ways to increase the number of potential trading partners. For example, in 2013 GE introduced a platform called CNG in a Box that opened up many markets, including many markets in LMICs, to its compressed natural gas (CNG) products. The box was a standard shipping container easily loaded on trains, on the back of a typical 18-wheel truck or in an ocean-going container ship. Inside the box was a motor, a compressor and everything else needed in a compressed natural gas fueling station. Before CNG in a Box, customers were asking for CNG sellers to invest in stations that could deliver compressed natural gas in a specific location, using connections that might be specific to the customer. GE could produce and deploy CNG in a Box without any concerns of being “held up” – if a buyer tried to lower the price, GE could just pick up the box and take it to a different customer.

Second, mature markets allow buyers and sellers to develop reputations – reputations that can overcome some of the concerns related to specificity. For example, even if an SHS provider remains the only electricity provider in the area, it has the incentive to increase demand for services by supporting complementary product or service providers, such as appliance distributors. Over time, the SHS can develop a reputation for continuing to transact without exploiting the appliance provider, and the SHS has the incentive to maintain that reputation in order to encourage other appliance providers to enter the market.

Rather than being an inherently good or bad thing, vertical integration in off-grid energy (or any industry for that matter) is often a necessary feature of early-stage market development that gives way to disintegration as the industry matures. Indeed, this cycle may happen multiple times, as innovations disrupt an industry and introduce new business models.[6] By looking to the experience of other industries, we can better understand where we are in these cycles – and how best to make the investments that will accelerate the development of efficient markets.

[1] Klein, B., Crawford, R. G. & Alchian, A. A. 1978. Vertical Integration, Appropriable Rents, and the Competitive Contracting Process. The Journal of Law & Economics Vol. 21, No. 2 (October 1978). pp. 297-326

[2] LaFontaine, F. & Slade, M. 2007. Vertical Integration and Firm Boundaries: The Evidence. Journal of Economic Literature Vol. XLV (September 2007). pp. 629–685

[3] Klein, B., Crawford, R. G. & Alchian, A. A. 1978. Vertical Integration, Appropriable Rents, and the Competitive Contracting Process. The Journal of Law & Economics Vol. 21, No. 2 (October 1978). pp. 297-326

[4] Klein, B. 2007. The Economic Lessons of Fisher Body–General Motors. Int. J. of the Economics of Business, Vol. 14, No. 1, February 2007. pp. 1–36

[5] Coase, R. 2006. The Conduct of Economics: The Example of Fisher Body and General Motors. Journal of Economics & Management Strategy, Volume 15, Number 2, Summer 2006. pp. 255–278

[6] Foster, J. & Metcalfe, J.S. 2003. Frontiers of Evolutionary Economics: Competition, Self-Organization, and Innovation Policy. Edward Elgar Publishing, Incorporated. pp. 56-59

Paul Clyde, President

William Davidson Institute

Paul Clyde is the president of WDI, the Tom Lantos Professor of Business Administration and the Movses and Maija Kaldjian Collegiate Lecturer of Business Economics and Public Policy at the University of Michigan’s Ross School of Business.

Colm Fay, Program Manager

William Davidson Institute

Colm Fay is a program manager leading the Energy Sector at WDI. He leads research projects focused on identifying innovative approaches to power generation and designing commercially viable business models.

Photo courtesy of andreas160578.

“These relationships flow both ways: faculty turn to us for help in their work and we will incorporate them in specific projects we are working on. Our work increasingly integrates our expertise between sectors within WDI as well as with the expertise across the university.”

—Paul Clyde, President of WDI

WDI teams of staff and/or students worked on nearly 50 projects in more than 30 countries in 2019. Our work focused on our core consulting sectors – education, energy, finance and healthcare, as well as our management education programs, entrepreneurship development, measurement and evaluation services and the deployment of University of Michigan graduate students around the world. In the course of the year, WDI worked with faculty and researchers at the U-M Ross School of Business, the Zell Lurie Institute, Law School, the School of Public Health, the College of Engineering, the School of Nursing, the College of Literature, Science and Arts, School of Education, College of Pharmacy, Medical School, Kellogg Eye Center, School of Information, and the School of Environment and Sustainability.

“Our work capitalizes on the expertise of our staff as well as the expertise across campus,” said WDI President Paul Clyde. “Over the past 12 months we have worked with 30 faculty and many students from Ross but also students and/or faculty from a number of other schools within U-M. These relationships flow both ways: faculty turn to us for help in their work and we will incorporate them in specific projects we are working on. Our work increasingly integrates our expertise between sectors within WDI as well as with the expertise across the university.”

Here is a closer look at some highlights from 2019:

The Education consulting sector and its Entrepreneurship Development Center (EDC) continued its work on the LIFE Project, which supports refugees in Turkey as they become entrepreneurs in the food sector. In July, WDI staff members Amy Gillett and Kristin Kelterborn and faculty affiliate Eric Fretz visited the Turkish cities of Istanbul and Mersin. Watch a narrated slideshow below of their trip that details the work they did while there and the program graduates they met. Gillett and Kelterborn also wrote an article for WDI’s affiliated NextBillion website on how to accelerate the success of refugee entrepreneurs.

Building off the success of its M2GATE Program (for more on the program, watch a video below here), WDI’s Education sector is facilitating a new virtual exchange course at the U-M Ross School of Business. Read about Business & Culture: A Virtual Practicum here. And read a WDI Impact Report on virtual exchange written in March.

The Education team also delivered another successful leadership workshop for NGOs in Central and Eastern Europe. Watch an entertaining and informative video on the latest workshop here. The next NGO workshop will take place in May 2020 in Warsaw, Poland.

WDI’s Energy consulting sector, established formally in 2018, explored the hot topic of renewable mini-grids to increase energy access. Specifically, the energy team is beginning to work with local partners in the Bagladeshi village of Bagdumur to determine the viability of a mini-grid there. In early 2019, WDI also deployed graduate students from the U-M’s School for Environment and Sustainability to study how energy enterprises in India and Uganda perform and how best to document it.

WDI’s Healthcare consulting sector team members Michael Krautmann and Ben Davis traveled to Tanzania for a U.S. Agency for International Development project to help strengthen that country’s health supply chain systems. Krautmann also sat down for a Q&A about his supply chain work at WDI, and Healthcare sector faculty affiliate Ari Schwayder answered five questions about his favorite health projects to work on.

WDI’s Healthcare team also conducted a project with the Linked Foundation to inform social enterprise, med-tech, digital health, and private sector investment in Latin America. The Foundation seeks to identify market-based, impact investment opportunities specific to women’s health in Latin America, based on an integrated assessment of the major unmet needs in combination with identification of high-impact solutions and opportunities to foster the enterprise ecosystem and sustainable women’s health solutions. WDI developed an analytic methodology, conducted a landscaping study for Colombia and Peru, and will be publishing the report in January 2020. WDI and the Linked Foundation also had the opportunity to present project findings at four conference settings in the U.S. and Latin America in fall 2019. Linked anticipates this work will inform their investment strategy and catalyze additional resources to the most-needed areas in women’s health in Latin America.

WDI President Paul Clyde wrote an article exploring the profit potential for health care companies in low- and middle-income countries.

WDI Vice President for Healthcare Pascale Leroueil continued her work helping global health organizations such as Global Fund, Gavi and WHO to increase the impact of their investments.

At the beginning of 2019, WDI Vice President of Administration Claire Hogikyan traveled to Ethiopia as the first phase of work to help that country find a sustainable solution to its medical waste problem. Her trip led to the deployment of a team of Ross School graduate students a couple of months later. They developed a proposal that was presented to government officials by an organization that plans to begin operations in early 2020 of a medical waste incinerator outside Addis Ababa.

WDI’s Finance consulting sector partnered with the Ross School of Business and Professor Gautam Kaul on a first-of-its-kind curriculum-based, student-run international investment fund.

The Finance sector team also partnered with Awash Bank in Ethiopia to study a remittance program to increase peoples’ access to capital. How the program would work is explained in this infographic and in this concept note.

In 2019, the Performance Measurement & Improvement (PMI) team continued work on several ongoing projects, including whether developmental evaluation works in a USAID context and using impact data to develop strategies to increase engagement of women in Colombia’s coffee sector. PMI Senior Research Associate Rebecca Baylor also shared her views in an article exploring whether developmental evaluation is an appropriate assessment strategy.

PMI also collaborated with other WDI consulting sectors such as Education, Energy and Healthcare to provide assessment services on their projects, including evaluating the impact of the Business and Culture course. Working alongside the PMI team on that project is WDI Faculty Affiliate Andy Grogan-Kaylor. Read a Q&A about his work and why he enjoys collaborating with the PMI team.

The PMI team also attended several conference proceedings in the impact measurement field and often spoke on panels and roundtables about their work. They led several discussions at the November 2019 American Evaluation Association annual conference. After attending and moderating a discussion at a global metrics conference, Baylor wrote about what is being done to incorporate gender equality into the impact measurement space.

The past year featured several opportunities for University of Michigan students to participate in WDI-sponsored projects. In all, 76 U-M students traveled abroad for WDI work.

Occasionally, students may participate in multiple WDI-sponsored projects. To reward these hard-working, committed students, WDI established the Davidson Field Scholar program. There are currently nine students who have earned this honor.

WDI sponsored 11 Multidisciplinary Action Project (MAP) teams in 2019, and deployed five teams to five countries to study ways to improve healthcare delivery there. One MAP team member who worked in Rwanda recorded her thoughts about the project for a narrated slideshow. (See below).

And we also caught up with a couple of former students – one in South Korea and the other in India – who participated in WDI student projects to see how working on these projects impacted their career paths.

“While I knew it would serve as a useful resource, I did not realize just how helpful the Institute would be until I got to Ross and started interacting with the staff and professors associated with WDI,” Puneet Goenka, WDI alumnus said.

And as part of the WDI Global Impact Speaker Series, the Institute hosted four guest speakers – Sally Stephens of Medicines360; Tami Kesselman of Aligned Investing Global; Ujjwal Kumar of Honeywell and Efosa Ojomo of the Clayton Christensen Institute. Watch an interview with Stephens here; an interview with Kesselman here; and watch Ojomo’s talk here.

There are currently about 26 million refugees globally, the highest number on record.

Turkey hosts more refugees than any country in the world, including 3.6 million Syrian refugees. Like refugees in other countries, Syrians in Turkey must find work in order to support themselves and their families in a new country. Because entering the formal labor market is difficult, entrepreneurship gives refugees a potential way to a sustainable livelihood.

To support refugees in building their own businesses in Turkey, the Livelihoods Innovation through Food Entrepreneurship (LIFE) Project has established two food incubators in the cities of Istanbul and Mersin. Refugees participate in a four-month entrepreneurship incubation program and receive business support services. Over two years, the project has graduated more than 250 entrepreneurs.

WDI is a member of the LIFE Project Consortium, which is led by the Center for International Private Enterprise (CIPE) and funded by the U.S. State Department Bureau for Population, Refugees and Migration (PRM). WDI’s Entrepreneurship Development Center leads the design and development of the curriculum for the entrepreneurship incubation program and supports in-country staff with building their instructional skills. In addition to CIPE and WDI, Consortium members include Union Kitchen and The Stimson Center, all based in the United States, and IDEMA, the project’s implementing partner based in Turkey.

In July, WDI’s Amy Gillett, vice president of Education, and Kristin Babbie Kelterborn, senior project manager, along with Eric Fretz, a WDI faculty affiliate and professor at the University of Michigan, traveled to Istanbul and Mersin to lead workshops on entrepreneurship curriculum development, participate in a business pitch competition for Mersin’s second cohort of entrepreneurs and interview program graduates.

Using some of the photos the pair took, Gillett talks about the trip to Turkey, the work they did and the entrepreneurs they met.

Cross-cultural relationships in business can be challenging, but students adept at navigating them are far more likely to excel in business— not to mention a host of other global professions and fields.

A unique course, offered at the Ross School of Business and facilitated by WDI, will equip students with the skills they need to work on cross-cultural, geographically dispersed teams so common in today’s business world. Open to all majors, the course uses technology to connect U-M students with their peers in Egypt, Lebanon and Libya.

Business & Culture: A Virtual Practicum (BA310), a new 14-week, three-credit course, will serve up a mix of traditional classroom sessions and hands-on, experiential activities. The innovative course will be offered in the winter 2020 semester and most students may register through Wolverine Access now.

The course will increase students’ awareness of the scope and nature of cross-cultural business and allow them to apply their new knowledge through work in international teams. It will be led by Ross Clinical Assistant Professor and WDI Faculty Affiliate John Branch, along with professors from American University in Cairo and American University in Beirut and the founder of the Benghazi Youth for Technology and Entrepreneurship in Libya.

“Success in business, and increasingly also in life in general, requires cultural competence—the ability to navigate culturally awkward situations, respect for alternative worldviews and the skills to lead people who are different,” Branch said. “Arguably, when it comes to developing cultural competence, nothing can replace a cross-cultural experience living, studying, or working abroad.”

But Branch said today’s interconnected world allows a simulation of a cross-cultural experience.

“Using the internet and other technologies, it enables students from four countries to work and study together,” he said. “They will ‘attend’ course sessions together, studying cases which reveal unique cultural approaches to business.”

Students will maintain a journal filled with their cultural reflections and also participate in an online discussion forum with their international peers where ideas, opinions and questions are shared. For the final project, students will form international teams and research and plan the internationalization of a fictitious company.

The course is expected to run four times beginning winter 2020. It builds off WDI’s successful project from 2017 and 2018, the MENA-Michigan Initiative for Global Action Through Entrepreneurship (M²GATE) program. That project brought together more than 400 students from five Michigan university campuses, including U-M, and their peers in Egypt, Libya, Morocco and Tunisia. M²GATE and the Business & Culture course were both supported by the Stevens Initiative, which is sponsored by the U.S. Department of State, with funding provided by the U.S. Government, and is administered by the Aspen Institute. The Stevens Initiative is also supported by the Bezos Family Foundation and the governments of Morocco and the United Arab Emirates.

In addition, WDI’s Performance Measurement and Improvement (PMI) will evaluate the impact the program has on students in the U.S., Libya, Lebanon and Egypt in areas such as empathy and cross-cultural skills, and use the findings to look for ways to improve subsequent BA310 classes. The data from the PMI team’s work also will be used to optimize future virtual exchange courses.

“Virtual exchange is an ideal way to prepare students for the global workforce they’ll soon be part of,” said Amy Gillett, academic advisor of the new program and vice president of WDI’s Education sector. “It’s also a fun and exciting way to learn and a great way to build an international network.”

One of the authors of a book presenting a new framework for fighting poverty based on entrepreneurship and market-creating innovation will give an Oct. 11 talk co-sponsored by WDI and Poverty Solutions at the University of Michigan.

The talk by Efosa Ojomo, an author of “The Prosperity Paradox: How Innovation Can Lift Nations Out of Poverty,” will begin at noon at the U-M School of Social Work in room B780. It is free and open to the public.

UPDATE: Watch Ojomo’s Oct. 11 talk here:

Ojomo is a senior research fellow at the Clayton Christensen Institute, a nonprofit think tank that aims to improve pressing global issues such as education, healthcare and economic prosperity through what it calls “disruptive innovation.”

He leads the Christensen Institute’s Global Prosperity research and works with Harvard Business School Professor Clayton Christensen to help entrepreneurs, policy makers and development practitioners stimulate economic prosperity in their regions. Ojomo earned a bachelor’s degree in computer engineering from Vanderbilt University and an MBA from Harvard Business School.

In The Prosperity Paradox, Ojomo, Christensen and third author Karen Dillon, former editor of Harvard Business Review magazine, note why many economic development models fail and how the right kind of innovation can build businesses and lift up countries. Christensen also is the author of several New York Times best-sellers, including “The Innovator’s Dilemma” and “The Innovator’s Solution.”

Poverty Solutions is a university-wide attempt to examine and test models to ease the effects of poverty and disseminate those learnings. Working with community groups and supports active-learning options for students, Poverty Solutions was launched in 2016 by U-M President Mark Schlissel.

Members of the International Investment Fund and MADE MAP teams working in India this past March.

WDI is partnering with the Ross School of Business and Finance Professor Gautam Kaul to establish a curriculum-based, student-run international investment fund at the University of Michigan, believed to be the first of its kind at a U.S. university.

The fund, called the International Investment Fund (IIF), will target small- and medium-sized enterprises (SMEs) in India. Graduate students enrolled at Ross and in joint-degree programs with other U-M schools and colleges will be responsible for investing, managing and growing the investment portfolio as part of a course at Ross. WDI has worked closely with Kaul to develop the fund and made an initial financial commitment to the fund.

And while the course at Ross won’t begin until winter semester in 2020, work has been ongoing for multiple years. This past winter a Ross student MBA team sponsored by WDI traveled to India to conduct an initial round of due diligence on local SMEs to assess the viability of the process and the potential for investments. Students and Ross faculty are also working to establish a protocol for the fund and received assistance from the University of Michigan Law School on the legal requirements on both the U.S. and Indian sides.

And while the course at Ross won’t begin until winter semester in 2020, work has been ongoing for multiple years. This past winter a Ross student MBA team sponsored by WDI traveled to India to conduct an initial round of due diligence on local SMEs to assess the viability of the process and the potential for investments. Students and Ross faculty are also working to establish a protocol for the fund and received assistance from the University of Michigan Law School on the legal requirements on both the U.S. and Indian sides.

Forty students applied to be part of the fund and the class and 13 were selected. They will travel to India in August to conduct more work and due diligence on SMEs. Another 13 students will be added during the next academic year, Kaul said, and the eventual target for the fund is 35-40 student advisors all chosen after a rigorous application and interview process.

Kaul, who started Ross’ successful Social Venture Fund, said he has thought about an international fund for years and has received encouragement from students to start one. He said he started work with some second- and third-year MBA, Erb Institute and public policy graduate students on the idea about four years ago. He said it became obvious he couldn’t replicate the Social Venture Fund, which invests only in the U.S.

Professor Gautam Kaul

“It’s quite an adventure to go to another country and initiate something so complex,” said Kaul, the Robert G. Rodkey Collegiate Professor of Business Administration & Professor of Finance. “Just to get to know the system takes a while.”

He also said the university and Ross didn’t want to start this alone, but potential international partners on the ground “wanted proof of concept.”

Kaul approached WDI President Paul Clyde to see if the institute was interested in partnering because of its global focus and work with budding entrepreneurs. Clyde said the idea of an international investment fund “fit with our Finance sector goals, which is to figure out ways to make funding available at a lower cost to small- and medium-sized enterprises.”

Additionally, in 2017 WDI, the Zell Lurie Institute for Entrepreneurial Studies at Ross and the Aparajitha Foundations in India established the Michigan Academy for the Development of Entrepreneurs (MADE), a nonprofit institute. MADE works with entrepreneurship development organizations (EDOs) in the Tamil Nadu state of India to give individuals operating businesses in these environments the knowledge and best practices they need to thrive.

Kaul said it is a “huge advantage” that WDI has a partner on the ground in India already working with entrepreneurs.

Twenty-seven SMEs recently completed a business development program managed by MADE and its EDO, Poornatha. The entrepreneurs took monthly classes at MADE designed to help them develop financial projections, future financial plans and other necessities for potential funders, including complete financial statements.

Clyde said each of the 27 SMEs are entrepreneurs with a vision where they want to go, who have identified areas they saw as opportunities for growth and are in need of capital investment.

WDI President Paul Clyde

“And we know something about their character,” he said. “Through MADE, our partner has spent a lot of time getting to know them. They weren’t a random group of people. Further, we had always planned to add financing to the array of products and services offered by MADE.

“So when Gautam called with this opportunity to marry what we were already doing with MADE with this investment fund, it seemed like a perfect fit.”

Kaul said he hopes the fund will make its first investment by the end of 2020. He said if the fund was making an investment in the U.S. it would take two months to do a deep due diligence after identifying a potential start up following some pre-screening.

“In the context of this Indian initiative, it’s never been done so it could take nine months,” he said. “The purpose here is to make an investment and hope it starts paying off. But all profits go back into the fund so we can invest in someone else.”

Kaul said the course and the investment fund is “very applied, on-the-ground, experiential” and what he thinks is the future of university education.

“It is very complex, which makes me very excited,” he said. “It has got the beginnings of what I think is the future of global education. It will differentiate Ross. You’re not coming here sitting in a classroom – well, maybe for the first six months – but after that you’re all over the world.

“You’re not learning just from faculty but from the environment and everything else. That’s what the demand is for.”

Kaul said WDI has been a great partner and instrumental in making the fund a reality. While WDI is located on campus and strongly affiliated with the university, its independence gives it flexibility and maneuverability for projects such as the investment fund.

“Without WDI, I would have given up,” he said.

Clyde said in addition to the initial investment, WDI will support the travel needs of the students running the fund. Kaul is the faculty advisor for the fund and Clyde said he will help where needed and continue to be closely involved.

Kaul said the fund appeals to students who want an international, hands-on experience, but may also want to work in global settings.

“If you want to go to India and eat Indian food, this is not for you,” he said. “This is serious stuff. You have to worry about global issues, you have to worry about India, and you must take ownership of your learning. If you go there, you should be keen on learning from and helping people on the ground.”

Note: The following post was originally published on NextBillion.net, which is managed by WDI.

By Amy Gillett and Kristin Babbie Kelter

There are currently 25.9 million refugees worldwide, as the world experiences the highest levels of displacement on record. These refugees fled their countries due to war, natural disaster or persecution, and were often forced to leave behind their possessions, as well as their livelihoods. So they are, in many ways, forced to start over upon arrival in their new country.

This process begins with finding a new livelihood. However, refugees may have trouble landing a job due to discrimination, legal barriers, language limitations and lack of social networks. Given these hurdles, it is not surprising that some refugees turn to entrepreneurship out of necessity. Starting a business – especially if their customers are primarily fellow refugees – can allow them to sidestep the obstacles of discrimination and language. It is also attractive in that it enables independence, allowing the entrepreneur to “be their own boss.”

But starting a business is a challenge for anybody, and business failure rates are high. How do refugees — faced with the additional challenges of being new to a country and often not speaking the language — manage to establish successful enterprises? It turns out that along with their unique challenges, they also bring some unique assets to the table. These attributes can both position them for success and enable them to enrich their host nation.

Resilience is an attribute that is often associated with successful refugee entrepreneurs. Experiencing crisis in their home countries, coupled with the difficulties of relocation, help shape a mindset conducive to entrepreneurship. Successful refugee entrepreneurs are driven and have a “one-way ahead” attitude. This attitude is not just about succeeding: It’s about surviving and having a decent, meaningful life after having lost so much. “They really just want to get moving towards a better life in which they are able to work to benefit themselves, but also their families and their communities,” says Mari Kira, a lecturer and research scientist at the University of Michigan whose work explores career and identity growth among refugees.

Rima Bizri, a professor at Rafik Hariri University in Lebanon, wrote a case study of Mostafa, a Syrian refugee who was forced to shut down his restaurant back home, and started a new restaurant in Lebanon. According to Mostafa: “Success meant a lot to me, but survival meant even more … To me, failure meant starvation and homelessness … Failure was unthinkable.” Mostafa was supported by his wife, who shared his vision and drive. “All we could talk about is the restaurant … our lives were centered on the restaurant … it was our passion,” she said.

Indeed, refugee entrepreneurs are rarely alone in their entrepreneurial journey. They’re able to enlist the support of their family members, and fellow countrymen and countrywomen, by creating a shared vision and showing how the business will benefit all of them. This social network can be a vital source of labor and moral support. By tapping this network for employees, refugee entrepreneurs find workers who speak their language, have similar cultural values, feel an obligation to one another and have compassion for them. Even those who aren’t blood relatives come to be treated as members of the family, creating a “pseudo-family business.” Such a strong unit has an inherent advantage in finding entrepreneurial success: Notably, nearly one-quarter of small businesses fail because they haven’t assembled the right team.

Furthermore, refugees tend to be good at bootstrapping their businesses. They start out with their personal savings, and sometimes supplement that with contributions from friends and family. Money earned from customers is plowed back into the business. Since outside capital is generally not an option, they become adept at reducing their operating costs to a minimum and drawing on their social networks for support when needed.

Take the case of Shaker Moutraji, a member of the U.S.-government funded Livelihoods Innovation through Food Entrepreneurship (LIFE) Project. He owned seven sweet shops in Syria — specializing in cheese Mamul — before he closed them the week the civil war began. After leaving Syria, Moutraji did not have any capital to open a cheese Mamul production business in his new home in Mersin, Turkey. To overcome this barrier and launch a business, he bootstrapped by borrowing 600 Turkish Lira (about US $100) to purchase a used refrigerator and ingredients to get started.

While some refugee entrepreneurs may remain small and limited to serving the market of fellow refugees, others will move beyond this “enclave economy.” When refugee entrepreneurs offer goods and services that are competitively priced and in demand, host community members will become customers. They will benefit from these valuable new products and services, and the entrepreneurs will enjoy access to a much larger market.

For example, Fatma Ahmed, who fled from the armed conflict in Yemen, is working to reopen the pastry shop she had owned back home – but this time in Istanbul. Ahmed, also a member of the LIFE Project, understands the importance of tapping into the Turkish market to expand her customer base. She is learning as much as she can about Turkish culture, which is crucial for marketing her business to Turkish customers.

But even with a high drive to succeed and a solid business model, refugee entrepreneurs can still be stymied by obstacles. To help these entrepreneurs succeed, institutions within host countries can offer various types of support. Governments should help them register and operate their businesses as legal entities, as well as facilitate their access to international markets, such as through participation in trade expos. Governments should also seek to provide human and social services, such as education for youth, language classes, and access to social workers, health care, and basic needs like housing and food.

NGOs, support organizations like accelerators and incubators, and local universities can also help refugee entrepreneurs. They can assist by providing counsel on legal and export matters, providing office space and equipment during the initial startup phase, and offering training on relevant topics such as business models, marketing, customer service, finance and accounting, and human resource management.

When entrepreneurship support programs are created, they should, when possible, be open to both refugees and the host community. An influx of refugees in a community can lead to a strain on local resources like housing, schools, and jobs, especially in areas that were already experiencing economic instability. The competition over resources – in combination with varying social norms and the temporary status of refugees – can make it difficult for refugees and host communities to come together as one community. Entrepreneurship programs that engage refugees can seek to build social cohesion by opening the program to a diverse audience and facilitating positive interactions. A successful example of this is the International Labour Organization’s Ready for Business program, piloted recently in Indonesia. The program provides entrepreneurship training to refugees from Afghanistan, Somalia, Eritrea, Ethiopia, Yemen, Iraq, Myanmar and Sudan – as well as local youth in the Jakarta neighborhoods where refugee shelters are located. The LIFE Project takes a similar approach to building sustainable livelihoods through entrepreneurship: its food incubator model and suite of business support services in Turkey engage refugees from countries such as Syria, Yemen, Palestine and Iraq, as well as local Turks. The project also has a gastrodiplomacy component to facilitate meaningful connections across cultures, using food as a vehicle.

While every refugee entrepreneur has a unique story, those who are successful can challenge the negative perceptions and images of refugees that often arise during humanitarian crises. This can help their host communities shift from viewing refugees as a financial and social burden, to seeing them as a source of vitality, spurring economic growth and job creation and introducing new products to the market. Successful refugee entrepreneurs bring focus, drive and commitment to their ventures, modeling the mindset any entrepreneur needs to grow a business.

Amy Gillett is the vice president of education at WDI. Kristin Babbie Kelterborn is a senior project manager at WDI. They lead WDI’s Entrepreneurship Development Center.

The authors would like to thank Rimi Bizri, Mari Kira, Eric Fretz and Ozge Savas for their contributions.

Photo courtesy of the Life Project.

For the past three years, WDI has been working in partnership with the Center for Private Enterprise (CIPE) to develop curriculum and instructional materials to be introduced at universities in Papua New Guinea. Initially, the project supported three PNG universities; a fourth was added in 2018 — the Institute of Business Studies University (IBSU). WDI Faculty Affiliate Julie Felker took her fifth visit to Port Moresby in November 2019 to run a workshop on entrepreneurship and advise the four universities on next steps in their entrepreneurship course development.

WDI is working with the Center for International Private Enterprise (CIPE) to develop curriculum and teachers’ guides for a training program on access to finance for entrepreneurs in Algeria. Working closely with WDI staff, a WDI consultant is developing modules in the areas of financing fundamentals, financial management for growth, creating business plans and business pitching. WDI’s curricular modules will be used by local trainers in Algeria in a four-day interactive course targeted at owners of fast-growing, small- and medium-sized enterprises.